There are various buzzwords that seem to have taken hold within the media monitoring industry – and we all get used to them very easily. Over the last few years, it has become commonplace to talk about Social Media, Connecting Data and Big Data, then moving on to Media Intelligence, Content Marketing and Content Distribution.

According to this year’s FIBEP Congress theme (see headline), the next big thing seems to be Business Intelligence (BI). We all may have an idea or two about BI, but: What does this mean for our industry? Is BI really the next step? Is our industry already a piece of the puzzle?

To answer this question, let’s take one step back and look at the bigger picture: Business Intelligence is a field that uses different technologies to enable executives to make smarter decisions based on data. The data they use has various origins. There is financial data, customer data, marketing data, CRM data, historical data, and (social and traditional) media data, just to name a few.

Clearly, all of these sound really familiar to most companies from the field of media monitoring and analysis, and we can almost see these types of data interconnected through Media Intelligence technologies and services.

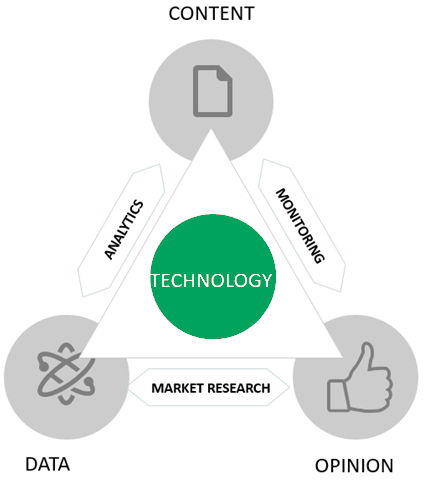

To illustrate this point, we will use a model based on three pillars: content, opinion and data. These three pillars will be connected by three nexuses: monitoring, market research and analytics.

Content: In our example, content includes paid media (e.g. content and advertisements from print or broadcast media), owned media (e.g. company websites and corporate blogs), and earned media (e.g. reactions on Facebook, Twitter, and YouTube).

Opinion: Opinion, in this instance, is equivalent to the public perception of a service or product. When we talk about opinion, we refer to posts from relevant message boards and influencer engagement through loyalty, advocacy and response.

Data: This pillar encompasses financial data, customer data, marketing data and CRM data, among other things.

Of these three pillars, content and opinion are the two that companies from the field of media monitoring and analysis work with on a regular basis. The types of data described above are mainly BI company territory.

Now, to describe the nexus between these three pillars, let’s look into content and opinion first. Media monitoring services in general work as a perfect link between these two. Monitoring includes a wide range of media intelligence solutions such as daily media reviews, influencer management tools, interactive platforms including automatic and semiautomatic services such as Software as a Service (SaaS) or editorial teams selecting relevant data for clients.

Moving on to the nexus between content and data, we are diving into the deep waters of analytics. Here we have a wide range too, from social media analytics to sponsorship and benchmarking analysis, as well as different KPIs, ROI and evolving consultancy services. Analytics are often reflected in terms of a company’s results and strategy.

Last but not least, there is the bond between opinion and data, market research, which might not be the most typical field for companies active in media monitoring and analysis, but which is increasingly a part of service portfolios nowadays.

In the middle of our interconnected pillars, there are different technologies enabling executives to make smarter decisions based on data. This was already part of our definition of Business Intelligence, so what’s the missing link between Media Intelligence and Business Intelligence according to our model?

To put it in a nutshell, the way of connecting all three pillars is through technology. We need to achieve the full integration of opinion, content and data, so the end user will be able to simply ask questions like “Which product should I discontinue?” or “Which product is most successful?”. The answers to these questions should emerge from the interaction of analytics, monitoring and market research data. This is something that BI tackles.

With this in mind, what are the main challenges for Media Intelligence companies?

- New competitors like IBM, SAS etc.

- New skills as well as technological and methodological competences.

- Positioning Media Intelligence companies within the BI sphere, given that Media Intelligence companies are newcomers in an already established market.

In light of all this, are demands leading us to become BI companies in the long run? Or should we rather consider a path from Media Intelligence towards Content Intelligence?