Evaluating one’s own communication work is still a serious challenge for many marketing, PR, and communication experts. On the one hand, they are faced with an enormous flood of data, and on the other, there is often uncertainty about which figures are meaningful and valid.

“Which metrics can be collected at all, and which of them will help us?”, “Which ones tell us whether we’re doing well or poorly?”, “What do the metrics mean for us and our media response analysis and where do we go from here?” are among the usual questions that pop up.

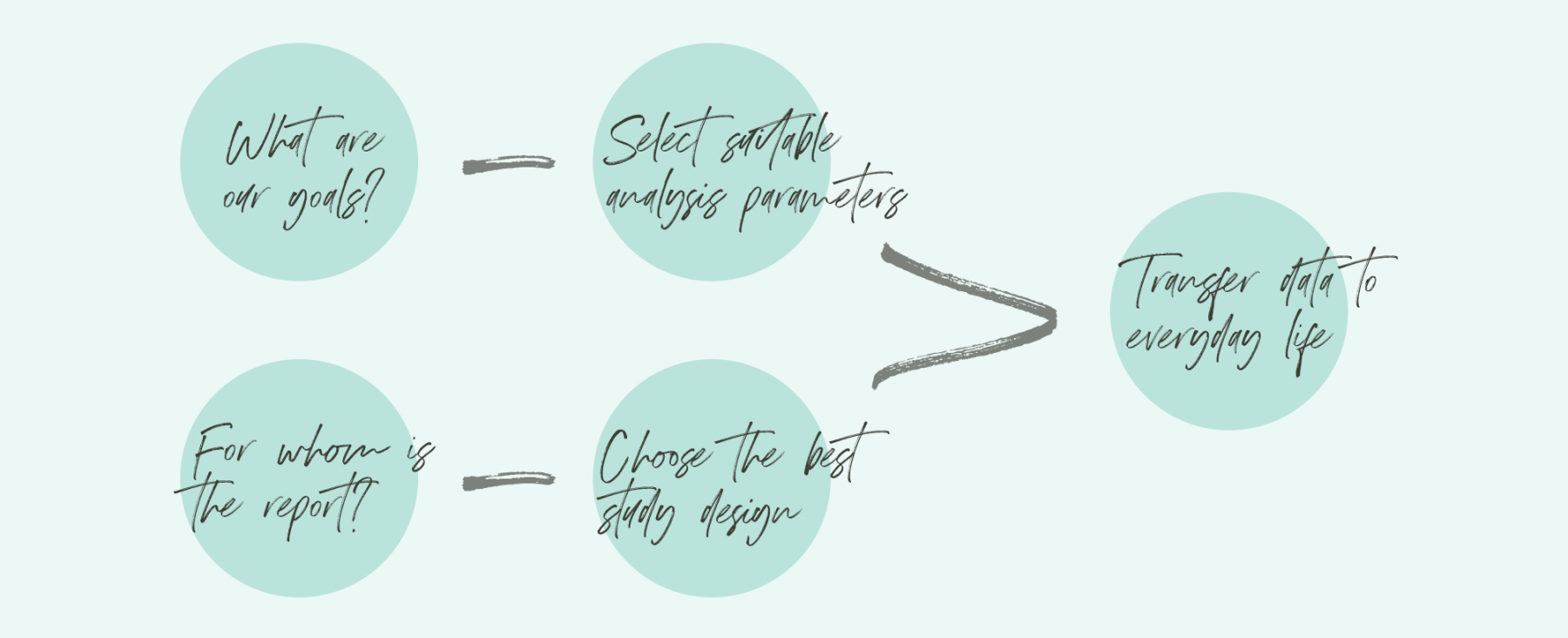

In order for each company and each team to derive answers that fit here, it makes sense to proceed step-by-step.

The first question to be answered should be, “What are our goals?”

What Are the Evaluation Goals?

Regardless of whether you are evaluating communication in traditional media or analyzing social media, at the beginning there is always the question — what is the purpose of measuring our communication efforts? Once that is cleared, it is relatively easy to come to the following question — what figures indicate the success of the achieved objectives? It is precisely these figures that should be measured and evaluated via media response analysis.

In other words, if you have set a goal, for example, of placing your product names in certain print media more frequently than in the previous year, you will need the number of mentions in the previous year as well as the number (buzz) from the current year. Provided that the media set has not been changed or at least not significantly, you can thus see in a direct comparison whether you are on the right track or whether you may need to readjust.

However, quantitative analysis parameters alone are not always sufficient. For example, if you have set a goal of launching certain messages and depicting your products or your company in a certain thematic context, you need an analysis that also approaches the media response in terms of content (qualitatively). More specifically, this means that for each article/post that has been published, it must be analyzed to what extent the desired messages have been adopted by the media/opinion leader and in what context the product/company has been mentioned. It will also be important to distinguish whether an article deals primarily (i.e., exclusively) with the product/company or whether it is merely a marginal mention.

If you also compare parameters such as sentiment, typical image attributes (e.g., “How is the company perceived as an employer brand?”, or “Is the company portrayed as innovative?”), reach, and article volumes over time, you will quickly get a detailed picture of how close you are to achieving your goals.

Media Response Analysis Thrives on Details

Once it has been clarified what information the analysis is to provide, it is important to also look at some of the details of the research design. For example, it can be useful to also take a look at the coverage of the competition. This can help to place one’s communication efforts in the overall context. Experts refer to this as “share-of-voice”.

Another aspect that often helps to assess the status of one’s communication work is the assessment of external and self-initiated articles. This shows very directly whether you control the reporting on your company yourself or whether you are also in the spotlight without any action on your part. In conjunction with your measures, you also get a definitive understanding of the extent to which your measures, such as press releases, press conferences, or journalist meetings, are successful.

Other typical questions include “Which and how many users exchange information about your company/products?”, “Who are the most important speakers?”, and “Where does the discussion on the given topics take place?”

Nonetheless, it is important to consider who should receive and understand the analysis report in the end. Is it for the board of directors that presumably has little time and little interest in detailed technical questions, but are all the more dependent on meaningful and condensed key figures? Should the analysis be prepared for marketing and communication experts who primarily want to know how to readjust the course for communications? Depending on the answer, the analysis should focus on charts that graphically present the numbers, include a clear management summary, or primarily derive recommendations for actions going forward.

Transferring Insights into Practice

However, no company that prepares an analysis or has one prepared should leave it at that. In order to derive lasting benefit from it, the data should be transferred into everyday practice. That means that it is necessary to weigh the results — which contributions, posts, and topics were taken up a lot and positively, and what has been met with little or no interest at all. Were there press releases and/or posts that particularly stood out? Could topics here be explored in more depth or taken further? If the analysis helps shape communications for the future, it can become an important part of daily work. Without that, it remains merely an interesting presentation at best.